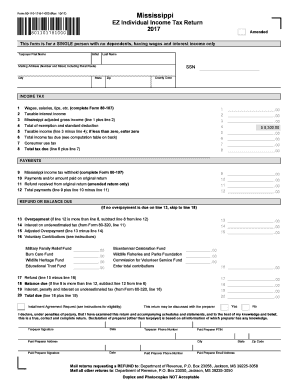

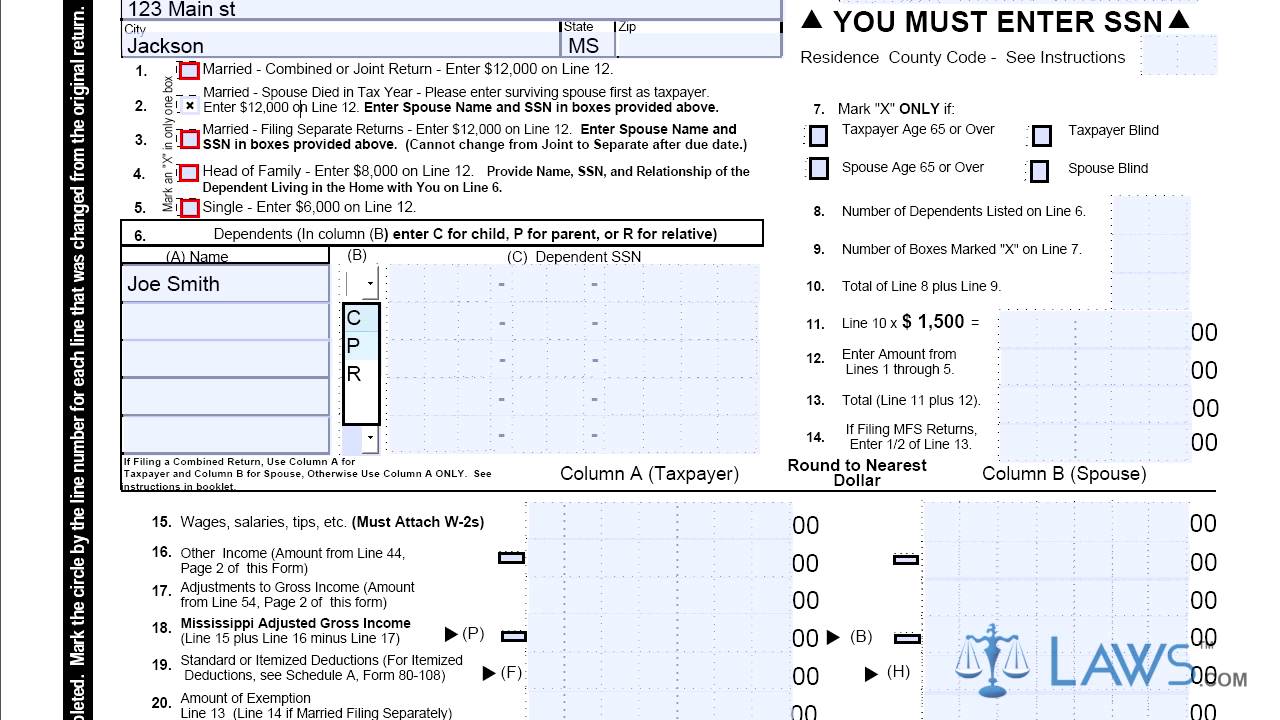

mississippi state income tax form

24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return. Below are forms for prior Tax Years starting with 2020.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

. The current tax year is 2021 with tax returns due in April 2022. Mississippi state income tax Form 80-105 must be postmarked by April 18 2022 in order to avoid penalties and late fees. This website provides information about the various taxes administered access to online filing and forms.

The sigNow extension was developed to help busy people like you to decrease the stress of signing legal forms. Department of Revenue - State Tax Forms. Mississippi has a state income tax that ranges between 3000 and 5000.

Start putting your signature on mississippi state tax forms 2021 using our solution and become one of the numerous satisfied clients whove previously experienced the advantages of in-mail signing. Department of the Treasury Internal Revenue Service Austin TX. TaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. You must file online or through the mail yearly by April 17. SCHEDULE A - ITEMIZED DEDUCTIONS ATTACH FEDERAL FORM 1040 SCHEDULE A In the event you filed using the standard deduction on your federal return and.

Taxpayer Access Point TAP Online access to your tax account is available through TAP. If you live in MISSISSIPPI. Once you have completed the form you may either e-mail it as an attachment to candsmdesmsgov or fax it to 601-321-6173 or print it out and mail it to.

Get Your Max Refund Today. Form 80-100 - Individual Income Tax Instructions. House Bill 1356 2021 Legislative Session Miss.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Tax rate of 0 on the first 1000 of taxable income. And you ARE NOT ENCLOSING A PAYMENT then use this address.

27-7-17 to provide that for the state income tax deduction authorized for depreciation in the. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face. Itemized Deductions Schedule 80108218pdf Reset Form Form 80-108-21-8-1-000 Rev.

0621 Mississippi Income Withholding Tax Schedule 2021 801072181000 Reset Form Print Form Primary Taxpayer Name as shown on Forms 80-105 80-205 and 81-110 THIS FORM MUST BE FILED EVEN IF YOU HAVE NO MISSISSIPPI WITHHOLDING A - Statement Information B -. Mississippi Form 80-160 Other State Tax Credit. Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return.

Ad Free 2020 Federal Tax Return. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. Printable Income Tax Forms.

And you ARE ENCLOSING A PAYMENT then use this address. 819 MISSISSIPPI EMPLOYEES WITHHOLDING EXEMPTION CERTIFICATE Employees Name SSN Employees Residence Address Marital Status EMPLOYEE. Mississippi Income Tax Forms.

Download the Employer Change Request form. Single File this form with your employer. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Form 80-105 is the general individual income tax form for Mississippi residents. Mississippi State Income Tax Forms for Tax Year 2021 Jan. The income tax return for the tax year for which the credit is certified.

Individual Income Tax Instructions. 3 LEGISLATIVE CHANGES REMINDERS 3 3 FILING REQUIREMENTS. Details on how to only prepare and print a Mississippi 2021 Tax Return.

Get A Jumpstart On Your Taxes. E-File Directly to the IRS State. We last updated Mississippi Form 80-108 in January 2022 from the Mississippi Department of Revenue.

To provide the order in which a rebate or credit shall be certified. 19 rows Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of Revenue. Welcome to The Mississippi Department of Revenue.

You may file your Form 80-105 with paper. Import Your Tax Forms And File For Your Max Refund Today. Box 22781 Jackson MS 39225-2781.

0621 Mississippi Individual Fiduciary Income Tax Voucher Instructions Who Must Make Estimated Tax Payments Every individual taxpayer who does not have at least eighty percent 80 of hisher annual tax liability prepaid through withholding must make estimated tax. File Now with TurboTax. Income and Withholding Tax Schedule 80107218pdf Form 80-107-21-8-1-000 Rev.

Otherwise you must withhold Mississippi income tax from the full amount of your wages. We will update this page with a new version of the form for 2023 as soon as it is made available by the Mississippi government. 18 Credit for tax paid to another state from Form 80-160 line 14.

Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. And you are filing a Form. Mississippi Department of Employment Security Tax Department PO.

These back taxes forms can not longer be e-Filed. The personal exemptions allowed. 0621 Print Form Mississippi Adjustments And Contributions 2021 801082181000 Taxpayer Name Page 1 SSN PART I.

Renew Your Driver License. This form is for income earned in tax year 2021 with tax returns due in April 2022. Form 80-100-21-1-1-000 Rev821 RESIDENT NON-RESIDENT AND PART-YEAR RESIDENT 2021 INCOME TAX INSTRUCTIONS INDIVIDUAL INCOME TAX BUREAU PO BOX 1033 JACKSON MS 39215-1033 WWWDORMSGOV fTABLE OF CONTENTS WHATS NEW.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. A downloadable PDF list of all available Individual Income Tax Forms. If you are receiving a refund.

All other income tax returns. Mississippi State Income Tax Forms for Tax Year 2021 Jan. Purchase Hunting Fishing License.

The Mississippi income tax rate for tax year 2021 is progressive from a low of 0. Attach other state return 19 Other credits from Form 80-401 line 1 21 Consumer use tax see instructions. Payment Voucher and Estimated Tax Voucher 80106218pdf Form 80-106-21-8-1-000 Rev.

The Department of Revenue is responsible for titling. Estimate payments may be filed on-line through TAP.

Free 7 Sample Tax Forms In Pdf

2014 Form Ms Dor 89 350 Fill Online Printable Fillable Blank Pdffiller

Get Ms Dor 89 350 2020 2022 Us Legal Forms

Irs Mississippi State Tax Form 80 170 Pdffiller

State W 4 Form Detailed Withholding Forms By State Chart

Income Tax Form Number 4 Exciting Parts Of Attending Income Tax Form Number Tax Forms Income Tax Income Tax Return

Irs Mississippi State Tax Form 80 110 Pdffiller

Mississippi Tax Rate H R Block

Individual Income Tax Forms Dor

Form 80 170 Mississippi Resident Amended Individual Income Tax Return Youtube

Wisconsin Tax Forms And Instructions For 2021 Form 1

California Tax Forms H R Block

Ohio Tax Forms 2021 Printable State Ohio It 1040 Form And It 1040 Instructions

Where S My State Refund Track Your Refund In Every State Taxact Blog

Income Tax Form Salary Why It Is Not The Best Time For Income Tax Form Salary Tax Forms Income Tax Tax Time

Mississippi State Tax Information Support

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller